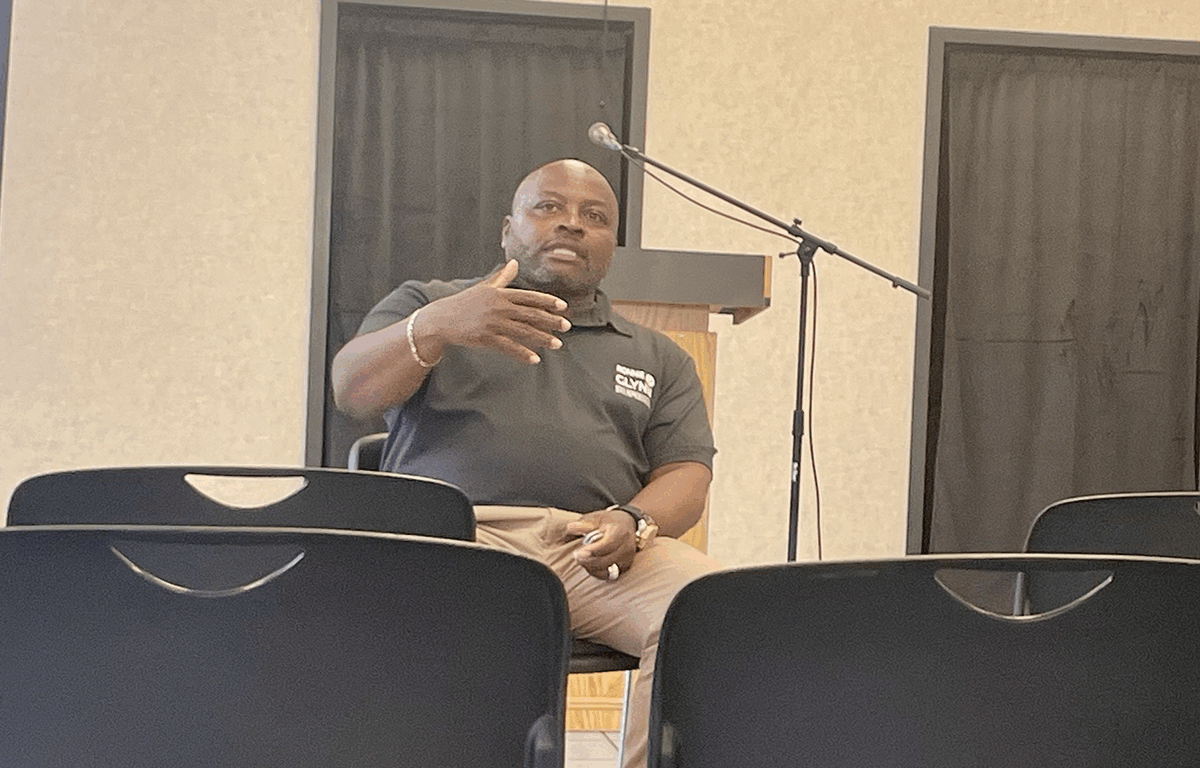

CLARKSVILLE, TN (CLARKSVILLE NOW) – State Rep. Ronnie Glynn, District 67, held a post-legislative session town hall on Wednesday, giving residents updates on the most recent activities of the Tennessee General Assembly. Alongside Glynn was Nashville state Rep. Vincent Dixie. The meeting was open to the public so Clarksville residents could share their thoughts and concerns, hear about the bills that were passed, and hear from Glynn on his plans moving forward.

Glynn explained that the last session was rushed, and they had to get out early. “They (the leadership of the House) pushed exactly what they wanted to push through and what was necessary,” Glynn said. “Everyone else was in the position where if your bill was behind the budget, it didn’t get a whole lot of attention.”

DEI bill passed

Among the bills that Glynn wanted to highlight was the DEI bill, which was approved and then signed by Gov. Bill Lee. The “Dismantle DEI Act” was sponsored by Glynn’s delegation colleague Rep. Aron Maberry, R-Clarksville. It bans the state and local governments and public colleges and universities from basing hiring decisions on an applicant’s race, color, religion, sex, national origin, age or disability, or hiring a particular candidate to achieve any goals to increase diversity, equity or inclusion in the workplace, according to the bill’s language.

“The DEI bill was obviously a very controversial bill, on so many levels,” Glynn said. “From my perspective, I could care less about the term ‘DEI’ or how it was framed; my problem was with how the DEI bill was presented. It was presented only because DEI was never an issue until we had a Black female (Kamala Harris) running for president.”

Glynn said his main concern was not DEI itself, but how banning it affects colleges and institutions.

“If you ask any college president how it has affected their school, they’ll tell you it’s a disaster. So many of the scholarships are offered to students who may be less fortunate – minorities, women, Black, male, female, whatever – that’s who it’s gonna affect in terms of the overall concept,” he said. Glynn said that sometimes the scholarships are why students are able to go to college.

Then there’s the problem of how to handle scholarship donors. “You have a $100,000 donor who wants to give all this money and wants these scholarships to go to minority kids who make under $20,000 – they can’t do that. That money can still go to the school, but it can’t be dictated on what it can be used for; the college has to put it in a general fund,” Glynn said.

“I think it’s a bad bill and sets up some bad business; we’ll see a shift in the wrong direction when it comes to helping minority and less fortunate kids.”

Constitutional amendment on bail

Glynn said three proposed constitutional amendments came up, including a proposed constitutional amendment on bail reform.

Under the proposed change, “a judge can now deny bail to someone who is accused of a crime based on a list of 73 different crimes that fit a category, to this particular criminal if they have been accused,” Glynn explained. He said that more crimes can be added to the list up until the day before Election Day, and that does not count early counting. He encouraged people to read the proposal and understand it.

Road improvements

In the new TDOT plan, Montgomery County has three approved road projects: Exit 8 and Rossview Road expansion, widening Interstate 24 from Exit 1 to Exit 11, and the expansion of Trenton Road and I-24.

Glynn said that Exit 8 and Rossview Road was the main one they wanted approval for. There is $26 million in funding, and construction is expected to start in 2028. He explained that the reason the Rossview Road expansion was before Trenton Road was because Montgomery County had already invested $20 million toward the project.

Trenton Road will get an expansion to five lanes, a bike path and sidewalks from north of I-24 to 101st Airborne Division Parkway. “101st will be completely different,” Glynn said.

Moving forward and concerns

Glynn shared concerns about where Tennessee’s budget is heading. “Based on what we know for now, there is a short bump in the budget,” he said.

“When they did the fuel tax in 2017-18, they did not include inflation. In other words, they taxed it, raised fuel tax, and that was it. They didn’t include inflation to roll over every year. Now fuel tax is still sitting at 17 cents when it should be at about 26 cents,” he said. “You have less fuel tax, less revenue going into transportation, and you’re not getting that revenue, so even transportation is in trouble. The question is, who is going to blink first? Someone has to blink and say, ‘We have to raise the fuel tax in order to get back to where we have to be,’ and this time making sure we include inflation.’”

| WANT MORE LOCAL NEWS? Sign up for our free Clarksville Now app