CLARKSVILLE, TN (CLARKSVILLE NOW) – The Clarksville City Council this week will take their first vote on a 2025-26 budget that includes more than $170 million for the city general fund, a 15-cent property tax increase, along with plans to address neighborhood flooding, rapid city growth and the Mason Rudolph Golf Course.

In a news release after Thursday’s City Council meeting, the City of Clarksville said the FY 2026 budget addresses the following key priorities:

- Retaining and recruiting the number of city employees required to ensure the workforce has the capacity and expertise to deliver vital services.

- Decisively attacking problems with neighborhood flooding that have plagued some areas of Clarksville for many decades.

- Keeping up with unsolicited growth in a city that has rapidly become one of the nation’s most popular residency destinations.

“The growth of our city’s population is driving every aspect of our budget, and we are successfully transforming our process from budget-driven goals, to goals-driven budgeting,” said Clarksville Mayor Joe Pitts.

“I am proud of how our employees in every city department work together, to respond to our citizens’ everyday needs – especially how they perform in a crisis or extreme challenge. They give us much to be proud of, and are to be commended for their efforts. That is why we are proposing a 2.5% general wage increase for all eligible employees as a centerpiece of our budget proposal,” Pitts said.

That proposal hasn’t satisfied a group pushing for increased salaries at Clarksville Fire Rescue, arguing that their pay isn’t keeping up with similar departments in other cities.

Proposed 15-cent tax increase

The city has proposed a 15-cent property tax rate increase this year, which would bring the rate to $1.03 per $100 assessed value. Growth, inflation and the critical need to expand services, adopt technological innovations, and increase workforce capacity are all driving the increase, the release said.

Former City of Clarksville Chief Financial Officer Laurie Matta, who accepted a job in Colorado recently, has continued to assist the city throughout the budget process, which included speaking at Thursday’s council meeting. She said the proposed 15-cent property tax increase is something the city does not take lightly.

“A tax rate increase is always the mayor and my last resort,” Matta said. “It’s definitely not something we’ve ever taken lightly, and it’s always a last thought. We look at everything else first. But, I’ve also been saying for a while now, an $0.88 tax rate is not sustainable for a community our size. It’s $0.88 per $100 of assessed value; we’re too large of a city to be sustainable at that level.

“So, a lot of people say growth should pay for itself. So, there’s two issues with that concept. State law won’t let us get ahead with growth. That certified tax rate process that we went through last year, is one of the ways they take growth away. As an example, last year with the certified tax rate, if we had stayed at a $1.23, then our revenues from property tax would have been $77.5 million. We would have received money from the growth. But, because of the certified tax rate process, our billing was only $47.2 million. Significant difference. … So, we did not receive that growth from the growth in our values,” Matta said.

‘I don’t believe that’s fair’

She also said the other problem with the certified tax rate process is that the state comes back with one number, and it’s supposed to be revenue-neutral. Last year, the city’s certified tax rate came back as $0.7488. “That was supposed to be revenue-neutral. We have proven time and time again, when this happens, we lose money. And we lose money because of the appeals process,” Matta said.

“The way the appeals process works is, if you get an assessment change, and it’s more than you want, you can appeal it. And you go to the board at the assessor’s office, and you can appeal that. That’s great, but there’s a timeframe that that takes place. It extends beyond when we have to approve the certified tax rate process. By the time the appeals come through, we get reduced revenue because if the appeal is successful, they reduce the revenue that we’re going to get from that taxpayer. So, we’ve proven a couple of times that it is over a $1 million that we lose each certified tax rate process.”

| DON’T MISS A STORY: Sign up for the free daily Clarksville Now email newsletter

Matta said she has gone to the state to show them the problem; however, state officials responded only by agreeing that there is a problem. Then, they suggested for the Clarksville City Council to increase taxes during every certified tax rate process to account for the loss in revenue.

“I don’t believe that’s fair to you all,” Matta told the council. “You’re elected officials, and they make you advertise it as a tax rate increase. I don’t think that’s fair to happen. Besides the certified tax rate process, the other piece when talking about growth paying for itself, is our normal growth for our city.

“Typically, our property values go up 5% a year, and that’s been trend since 2012. That would bring the size of our city $2.7 million annually. $2.7 million is not going to pay the growth we have in this city. That is minuscule in comparison to what our expenses are, just to provide the services that we have to provide. They say growth’s going to pay for itself, it does not,” she said.

Storm Water Utility

The City of Clarksville is looking to hire a consultant to explore creating a Storm Water Utility to “take the lead” in managing storm water infrastructure, which is currently under the Street Department. The change would move the responsibility under the Gas and Water Department.

Other steps are planned as well. “We will revise our building standards to reflect more-serious rainfalls we have received over the past 12 months. There will be code changes necessary to help limit the impact of heavy rains on homes and other residential and commercial structures,” the release said.

The Street Department is working with a consulting engineering firm to address three flood-prone areas. While the final price tag is unclear, the city has committed to making things right, which includes the preparation to come back to the City Council for changes in their financing plan, if necessary.

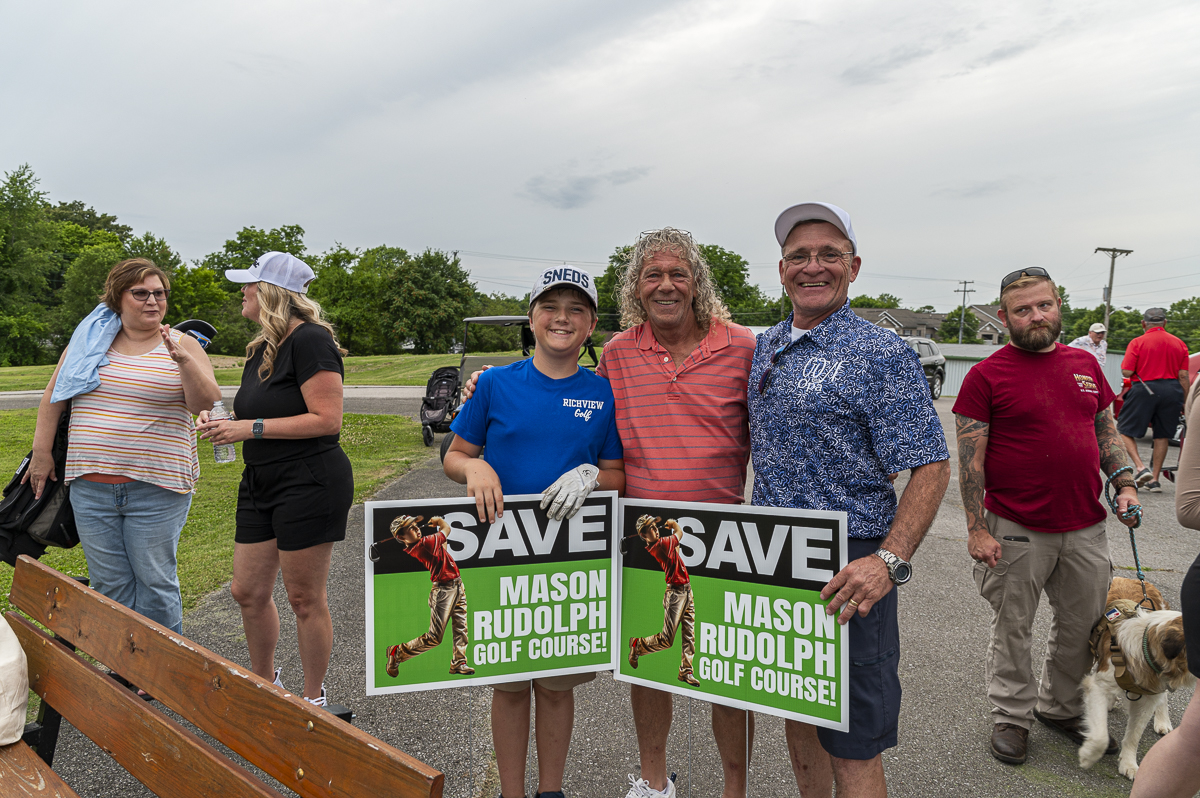

Mason Rudolph Golf Course

Matta told the council the general fund budget includes 30 new positions, one of them an Assistant Golf Course Superintendent for Mason Rudolph Golf Course, to “get that back up and fully functioning.”

| DOWNLOAD THE APP: Sign up for our free Clarksville Now app

Here’s a department breakdown of the additional new hires for the City of Clarksville:

- Five – Building & Codes.

- One – Building Facilities Maintenance.

- Eight – Fire & Rescue.

- One – Garage.

- Six – Parks & Recreation.

- Eight – CPD.

Capital projects update

As previously reported, the City of Clarksville has planned to throttle back capital projects for FY 2025-26. Instead, they will be focusing on completing more of the Transportation 2020+ projects, as well as the Rossview Athletic Complex Phase 1.

“We will make some necessary repairs to existing buildings, but we will not launch any new projects until the national and state economies settle. However, preliminary design and planning for other previously approved capital projects will continue,” said the release.

Construction of the Clarksville Performing Arts Center downtown will proceed on schedule. The city noted the project doesn’t fall under the city’s typical capital projects funding formula. It’s funded by the hotel-motel tax, which is paid by individuals who stay in hospitality lodging.

This was a point of conversation on Thursday, when Matta said after speaking with financial advisors and the bond council for the ACT Authority, the 2.75% hotel-motel tax rate is not going to bring in enough to cover the debt service to build the Performing Arts Center.

“We know there’s going to be a deficit there. … They’re going to have to do some fundraising in order to cover the gap,” Matta said.

What’s next

The City Council will continue considering the 2025-26 budget this week, with the first vote Tuesday, June 17, and the second vote Tuesday, June 24. Both special sessions will be at 4:30 p.m. in Council Chambers on Public Square.

| LATEST NEWS: Check out the most recent Clarksville news articles