CLARKSVILLE, Tenn (CLARKSVILLENOW) – A ‘bogus-check’ con has recently resurfaced in Clarksville in the form of a car-wrapping scam. The FTC released a report in 2016 first explaining the details of this scam to consumers.

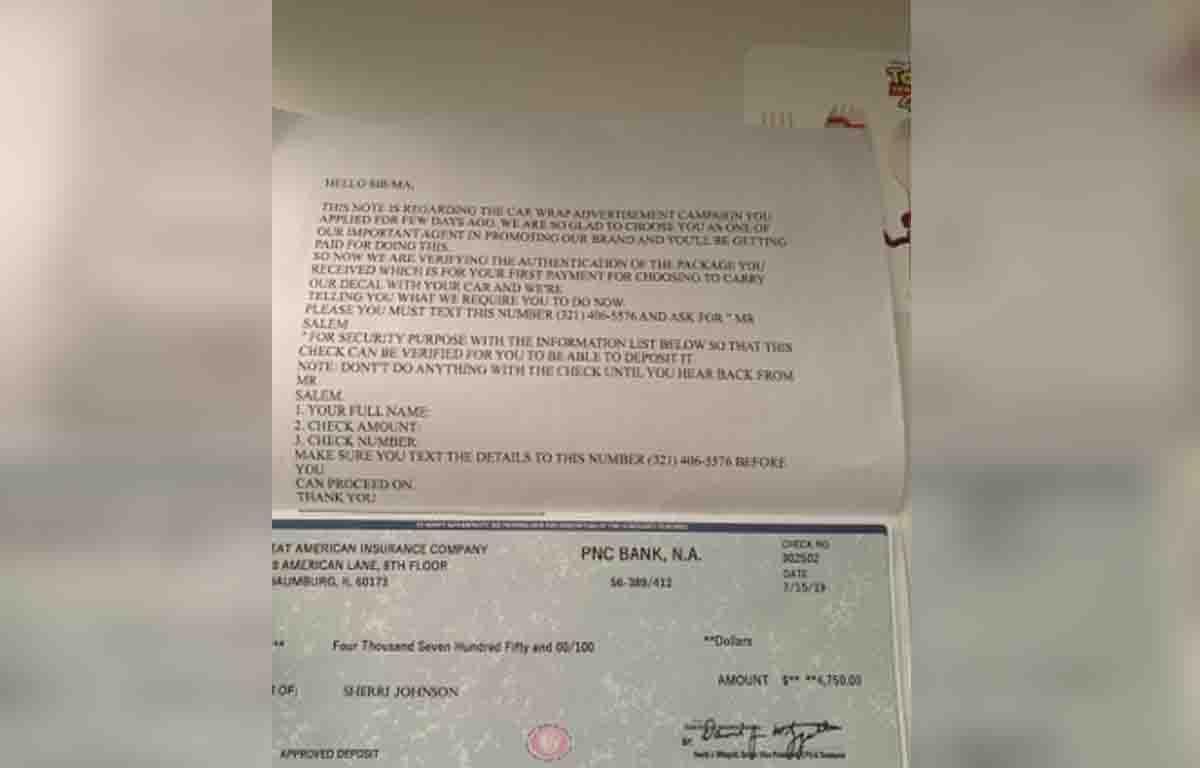

One Clarksville woman recently received a fake check saying it was from Dr. Pepper/Snapple. Sherri Johnson was asked to deposit the check she was sent and then withdraw $500.

Johnson alerted the police after she was contacted and one man showed up to collect the $500 and ‘wrap’ her car. She told him that she would have to cash the check at a Nashville bank, from where the check supposedly originated.

He stayed for a short time, but then left.

What to know about the “car wrap” scam.

In this scenario, the scammer pretends to represent a major soft drink company like Monster or Dr Pepper. They offer to pay their potential victim for having their vehicle wrapped with the company’s logo, usually offering $500 a week for 12 weeks ($6000 total).

The victim then receives a letter confirming they have been chosen for the program along with a check for a far greater sum than the agreed $6000. After the check is deposited, the scammer will ask that a portion of the money be wired back to pay for the expense of having the vehicle wrapped.

The problem is that the initial check bounces. By the time the victim’s bank catches the bad check, the wired money is gone. What’s more, many banks levy penalties and fees for bounced deposits.

Because the scammers usually transfer the money over-seas, there is little local law enforcement can do to retrieve money wired in this way.

Red Flags

Things to watch for if you’re approached with this scam.

- The scammer is unable to identify their affiliation with the company. Few companies have these types of wrap programs; and if they did, the company would reach out through official means. Pay attention to the email address used.

- Most ‘bogus check’ scammers are based outside of the U.S, English being their second language. Excessive grammar errors and strange wording can be a sign that not everything is as it seems.

- The scammer will request urgency in depositing and wiring the money. They want their victims to wire money before the initial check bounces.

The chance for extra income can feel like a blessing, and scammers prey on those under economic stress. If you receive an offer that seems too good to be true, check for the warning signs of a scam.

Should you fall victim to one of these scams, contact your bank immediately.